Complete guide

to virtual cards

Your safety layer for online shopping

Who is this

guide for?

This read aims to be the ultimate source for virtual cards information for Europeans. We will touch upon all major topics related to the mechanics, the use-cases, the providers and the costs of paying with personal virtual cards. We will also tell you about the different types of virtual cards and shed some light on various offerings, so you can make an informed decision when choosing how to protect your money when shopping online.

Virtual cards summary: They help keep your “real” card safe.

Introduction to

virtual cards

Has your debit card number been used maliciously before? Do you want to proactively protect your money online?

Virtual payment cards are a proven alternative to paying with the debit card linked to your primary account. They are an easy to use tool for preventing hackers from getting access to your money if any of your online shopping sprees turn into data breach or misuse.

For money- and tech-savvy people, this is already the go-to alternative to paying with your primary plastic VISA or Mastercard. Instead of taking out your real card during online checkout, or even worse - saving its details for a quicker purchase the next time, your wise option is to use a temporary virtual payment card, usually with its own reloadable balance.

You may be able to access virtual cards via your current online banking, or via any specialized virtual card provider/issuer, digital bank or an e-wallet/mobile wallet/digital wallet provider like our company iCard.

We have prepared a separate shorter material on our blog for a quicker introduction, the most common use-cases and how to quickly start with 2 free virtual cards.

Now, let’s explore all the magic behind the virtual payment debit and credit cards and what makes a no-plastic-carrier card so useful.

What are virtual cards?

The virtual card basics

They are payment instruments, usually VISA or Mastercard, that can be used only for distant or online payments, because there is no physical card that you can swipe or tap at POS terminals in retail shops, coffee shops, theatres, restaurants, public transport, etc.

They can be valid for a long-term, with an option to delete it, or they can be disposable, temporary or one-time use cards, usually created for just a single transaction or a service trial.

“Virtual cards make you less likely to have to deal with complaints and procedures for getting your money back if fraudsters get their hands on your payment information.”

Yavor Petrov, CEO of iCard

What is a virtual card exactly?

It is a virtually generated combination of payment card details - 16-digit card number, like on any VISA or Mastercard, name, expiration date and a security CVV/CVC code - everything that comes with your standard debit or credit card. Having no personalized and embossed card makes it possible to easily delete it after a single-use.

What are the benefits of a virtual card?

The virtual cards for online payments help you stay protected when shopping on the web. Since they are easily generated, you can easily dispose of them after each payment. This way, stolen card details cannot be used by hackers to steal money from you.

“It is like a protective wall, keeping the money in your regular account away from the online transactions and the risks involved, and is awesomely easy to use.”

Pavel Panayotov, Communications manager at iCard

You could possibly find a provider somewhere in the world that offers so-called no-name virtual cards that can make payments with a random cardholder name typed in the checkout form. These could potentially provide more privacy in particular circumstances. At our company, we comply with the European regulations to remotely identify all users before opening an electronic money account, wherever in the EEA you are.

Advantages of virtual cards

Let’s explore what makes virtual cards such an awesome commodity that protects us when shopping online.

Security:

Using a virtual card for payments reduces the risk of becoming a victim of fraud. It can’t be stolen and unlike plastic debit cards, no one can see your PIN because it does not exist for offline purchases or ATM transactions.

Some anonymity:

Safety of personal and payment details has become a concern for the ever-increasing number of people who prefer to save their personal data online for more convenience. Virtual debit cards are perfect for those of you who do not want to provide any information related to valuable card numbers and bank accounts.

Cost:

With no physical carrier to emboss details on and no shipping costs, it’s natural that virtual cards are even more of a commodity than classic debit and credit cards. With no delivery, it means they can be instantly issued and accessed online.

Time-saving:

It’s true that some physical banks may provide you with virtual cards, but in general, they are considered an innovative product. Usually, like with our company - iCard, account opening or setup will not require visiting an office or branch and all needed documents can be sent and verified online. Virtual cards can be ordered through a web or mobile app and simply takes far less time to start using them.

Mobility:

You can access them from anywhere and pay for goods or services in any country. The only thing you need is internet access. You will not face an on-the-go situation of having to return to take the card you forgot.

What are virtual cards used for?

Virtual cards use-cases

Most commonly, virtual cards are used for online shopping of products and services. They are also suitable for any distant purchases of services, subscriptions, entertainment, gaming, apps, or even trading.

"Virtual cards are a cutting edge protection shield for all online shopaholics. They are used in the same way any payment card is used but with additional and advanced features for security control and payment limits. They can be blocked and unblocked with a touch, in seconds and this way guarantee 100% security. Further, virtual cards are not linked to the users' current account and this way bear limited (and reversible) risk, only up to the loaded sum."

Nadezhda Marinova - CMO at iCard

Check section “Shopping with virtual cards” below to see what exactly people buy with virtual cards.

Are virtual cards better than physical?

In the online payments world - yes, however, each card is useful in different situations. You can consider your virtual debit cards as a good addition to your toolbox of instruments that protect you from the hassles of stolen card details.

We have also listed some disadvantages below, along with tips on how to navigate them.

Do virtual cards work for ATM withdrawals?

Yes and no, but it depends. This is a common and not very intuitive question. It may or may not be possible, depending on the capabilities of your virtual card provider. Mobile wallets, digital wallets or e-wallets like iCard or Apple Pay, Google Pay, Samsung Pay and others are more extensively turning to the tokenization technology to allow contactless card payments via mobile devices, or Mobile Payments. They are considered the natural next step in payments evolution because of the additional security features that make it nearly impossible to hack or steal.

Do virtual cards work for telephone payments?

Virtual cards’ primary purpose is to protect your online purchases, but in fact they also work for any distant payments - like phone payments. These rarely happen nowadays, but when they do your card details are not encrypted into a database. A real person gets a hold of all your card details, making the payment less secure than usual.

Do virtual cards work for recurring payments?

Yes, if you have an iCard virtual card or similar. Not if you have a disposable virtual card which expires after each payment. We will cover that in section “Types of virtual cards” - “Disposable vs Deletable”.

Fun fact:

Virtual cards used to be called Virtual numbers, short from virtual credit card numbers, which was confusing because virtual phone numbers were also referred to as virtual numbers.

Who uses virtual cards?

The two free virtual cards that iCard offers to every user (one VISA and one Mastercard) are the preferred choice for people with concerns about their protection online.

Virtual card users come from all demographics segments, but there is a noticeable preference with millennials - a particular group of society born between 1981 and 1996 - aged from 25-26 to 39-40. Late millennials and early Generation Z (the latest generation of consumers) who just get into the workforce are quite tech-savvy and seek information and apps to handle their money in a secure and modern way.

Users who are online shoppers and especially deal hunters are well familiar with the risks associated with online shopping like data breaches, hacker attacks and scammy web sellers. Awesome deals are sometimes too good to miss or too good to be true. Virtual cards come as a perfect solution if you want to risk it and purchase a product deal that you discovered through e.g. a Facebook ad, a social media link or search results. Malicious players sometimes manage to go through the filter cracks even of reputable web services like Google, Twitter, LinkedIn. So, you always need to be aware of the risks in order to protect your identity and money.

Virtual cards are not limited only to online shoppers even if they were initially designed for that purpose.

App and software users who use virtual cards are often early adopters of technology and knowledgeable of the risks. New and well-recognized software vendors from around the world, with different card payment processing capabilities, present some risk whether it’s a purchase of the full solution or just a trial. Their systems may fail to detect fraud, or they would close their eyes to any problems because borders separate them from the users and the monetary incentive is good enough. We don’t want to scare you, just inform you enough to stay protected.

Parents whose children are already actively exploring the webspace and sometimes need or want to purchase apps, games, software or content, also find virtual cards a particularly useful modern miracle. It saves parents from worries such as controlling the youngers’ budget, spending habits while avoiding misuse of their primary card/account.

Gamers and gamblers love all the latest from the gaming industry. This means going through games in days and moving on to the next. Full game purchases or trials carry the risks, not so much because of no-reputation sellers (most game producers are huge companies), but of data breaches. Social media game producer Zynga, for example, got 170M passwords stolen, Fortnite’s data breach brought a class-action lawsuit to the company. The list goes on with Nintendo, EA games and others, while BBC reports that one billion Android devices are at risk of hacking. More background and context on data breaches below in section “Reasons virtual cards exist.”

Freelancers have similar concerns because they pay for and use a lot of online services in their work for clients and projects. These are stock photo and video platforms, freelance job platforms, apps and various software for automation, design and video making to just name a few - with virtually all platforms taking payments with VISA or Mastercard.

Traders in cryptocurrencies, foreign exchange, commodities, options and stock too can and do fund their trading accounts with debit or credit cards. Every online payment carries some risk, so the natural choice for proactive users is to pay with virtual cards.

Digital entertainment users pay for monthly subscriptions and service trials with virtual cards. They give subscribers the convenience of simply deleting a virtual card to cancel the service, instead of looking for hidden menu options or chasing customer support to find out how to stop paying for something they don’t need.

Interesting fact:

Disposable virtual cards don’t work for rolling subscriptions. There are other use-cases where it’s not a good idea to pay with a virtual card, but more on that and the actual convenience of disposable cards in section “Types of virtual cards”.

Reasons virtual

cards exist

Consumers are not liable for being defrauded with unauthorized charges. Getting the money reversed back might take time and it can cause additional inconveniences when you need to pay rent for example.

Virtual cards are convenient, free or cheap, dispensable to make them useless if stolen. But what are the factors that contribute to the risks and consequently, to the expansion of virtual cards usage?

It’s our concerns as consumers:

Online shopping safety

Purchases from big retailers like Amazon or eBay can make us feel safe that the company will not abuse our payment information and will protect our data. However, if a merchant is new or we never dealt with them, there is a risk. We also might prefer shopping at new, small businesses - to support them because they are the backbone of every economy. Many times people fall for scams that are too good to be true. Yet, deal hunting might be good for our pockets. So, if we don’t want to miss “the deal of the day”, but want to protect our money, the option is: Pay with a virtual card. There are plenty of other online resources that can boost our knowledge and toolkits of online defence.

The convenience factor

We are in the middle of the purchase process. Having iCard on your phone, for example, means that your virtual cards are always there - a few taps away. Log into your digital wallet with a fingertip. Open the virtual card to reveal its 16-digit number, expiry date and CVV/CVC. Enter them on the website to get your deal. Done - delete it and if the merchant does not deliver, you may have the option for a chargeback dispute.

Virtual card providers - banks or fintech companies like iCard - offer mobile or an online version of the process. We will shortly cover the various options you have with different virtual cards and different account providers.

Hackers, viruses and phishing

Scammers, of course, try to get in the middle of the deal, either targeting us - the users, or the merchants.

They use different techniques, digital tools and social engineering to get access to our payment information.

Phishing is one of the most common attacks that can unfold in 9 different ways and your best defence is knowing how to spot one.

The SIM card swap scam can divert calls and messages to another SIM card in the criminal’s possessions. It happens rarely, getting access to all the information needed is a hard task even for the best hackers and not all mobile providers are willing to do it. Keep it in the back of your mind that if you lose signal for a prolonged time - over 10-20 minutes, one way to stay protected is to immediately contact your mobile operator, freeze your debit and credit cards, and change your passwords or PINs. iCard digital wallet lets you freeze your cards with a tap.

Data breaches

Data breaches are one of the reasons why virtual cards are so useful. Thousands of them occur each year and they carry financial loss for both the financial institutions responsible for protecting our money and us - the consumers.

Here are some of the biggest data breaches in history that made people consider counter-measures to the problem.

All of these leaks made news headlines and are the reason people now increasingly look for solutions such as virtual cards.

Adobe

2013

130 Million user records:

usernames, passwords, names and credit/debit card information

Adult friend finder

2016

412 Million user records:

names, emails, passwords

Canva

2019

137 Million user accounts:

emails, usernames, names, cities of residence, partial payment data information

eBay

2014

145 Million users:

names, addresses, dates of birth and encrypted passwords

Equifax

2017

148 Million users:

Social Security Numbers, birth dates, addresses

2012 & 2016

165 Million user:

accounts emails and passwords

Marriott International

2014 & 2018

500 Million customers:

contact information, passport numbers, travel, personal and payment information

My Fitness Pal

2018

150 Million accounts:

usernames, emails and passwords

MySpace

2013

360 Million user accounts:

usernames, emails and passwords

Yahoo

2013 & 2014

3 Billion user accounts:

names, email addresses, passwords, dates of birth and telephone numbers

Zynga

2019

218 Million user accounts:

user IDs, emails, passwords and phone numbers

(The list was originally compiled by csoonline.com)

There are many more - thousands of smaller attacks happening each year, in many countries. Some of them are not even reported or significant, compared to the ones above. Still, any personal information leaked can be misused and can cause problems. In this digital environment, virtual cards are a way to avoid temporary or permanent financial loss when paying online.

Although virtual cards have existed for over 10 years, they are now gaining momentum among consumers as a natural counter-measure to the increase of hackers capabilities.

Let’s dive into the technical details.

How virtual

cards work?

You already know they work similarly to standard credit and debit cards online, but let’s explore the particularities.

The networks: VISA & Mastercard

The majority of virtual cards offered to end-users in Europe are VISA or Mastercard - the 2 largest card payment networks in the world. It’s not impossible to find providers who are mostly reliant on the UP and JCB (Asia) or other local card schemes.

Just like your plastic debit or credit card, payments made with your virtual card are routed, processed and acquired by the same group of participants - you (the buyer), the merchant, the merchant’s bank, your card issuing institution and the payment network - VISA or Mastercard.

The issuers

Financial institutions such as banks, credit unions, payment processors and fintech e-money companies like iCard, who are licensed issuers, could offer virtual card facilities via browser or mobile technology. iCard, for example, is a principal member of both VISA and Mastercard.

Although it’s not common in Europe, but rather in the USA, your bank may even offer you virtual credit cards - directly connected and drawing from your credit limit.

Types of payments

How do virtual card payments work?

Exactly like your normal credit or debit card, except in retail shops or at ATMs, with rare exceptions.

One-time payments are the most commonly used type of transaction with a virtual card.

Recuring payments come with every subscription, and they work just like you would expect, as long as you don’t dispose of your virtual card, and it has enough balance for the transaction.

ATM withdrawals may be possible at contactless ATMs if youр virtual card can be added to digital wallets such as Google Pay, Apple Pay or Samsung Pay.

Refunds may or may not be possible. We will explain in a bit.

We get asked a lot: Can I get a payment to my virtual card?

OCT or “original credit transfer” is a method of payment sent directly to your card number, rather than to the account it draws money from. OCT payments are a common way for online casinos and gaming portals to pay winners.

Safety features

How to use virtual cards to stay safe?

Virtual cards could be your protective layer for your online shopping having the following 3 major security features:

- Freeze a virtual card after each use to render it useless if stolen. Unfreeze it again for a few moments until you make the next payment.

- Limits for your daily, weekly and monthly spend can play an equally important role in protecting your money if your card gets stolen in a data breach.

- Delete a card after one transaction to completely prevent it being used by a scammer.

Not all virtual card providers will be prepared to offer you a full set of features. Some will let you use the so-called “disposable” debit card. It gets automatically deleted after each transaction. This can definitely prevent thieves from getting their hands on your money, but it’s also not perfect for some use cases. Go to section “Types of virtual cards” to find out what options you have.

Here is a bit more information about iCard’s virtual cards:

What safety features should I expect from a virtual card provider?

As you already know, you can expect the same online purchase behaviour from virtual cards as you would from a plastic VISA or Mastercard.

iCard virtual cards for example support 3D Security or 3DS - Verified by Visa or Mastercard SecureCode. This is an additional step to verifying your payment credentials, usually interrupting the checkout process - rerouting verification to the payment network. 3D security only kicks in if the merchant has it activated on their website. Keep in mind that not every virtual card provider has enabled 3DS.

SCA or Strong Customer Authentication

SCA is a brand new European regulatory requirement to reduce fraud and make online payments more secure. It is becoming widely adopted with banks and fintech companies. In its essence, account providers let you log in with 2-factor authentication. One usually is your password and the second could be a one-time code received by SMS. SCA is part of the current technology trends that are reshaping the personal finance industry, leading to faster and faster adoption of mobile or electronic money.

We have prepared a separate resource on our blog that reveals details about iCard’s virtual cards and how they help you stay safe.

Why is a virtual card safer compared to a physical contactless debit card?

- A virtual card can’t be copied like physical cards. Neither the magnetic stripe nor the payment info on the NFC chip. They could be copied online, but the fact it’s a virtual card and the option for deleting it will render it useless if it happens;

- A virtual card can’t be lost because it does not exist in physical form.

Disadvantages of virtual cards

What are the drawbacks of virtual cards?

- One of the disadvantages of using a virtual card is that you have to log into an app or online banking to generate or buy a new virtual card to make a purchase.

- If you delete your virtual cards after each payment, it doesn’t make sense saving it at the retailer’s website, so it will take you more time the next time you checkout. As you know about data breaches, saving your payment details online doesn’t make much sense and one-click shopping can easily help you spend over your budget.

- Renting a car or purchasing theatre seats may not be possible with virtual cards because, usually, you need to present the same card that you used to make the booking. If it was a disposable or you deleted your card, this will be impossible. In such cases, you may still go ahead and purchase with a virtual card, but make sure you have your ID to prove your name at pickup.

- Virtual cards don’t work at high street retailer shops.

- Refunds to a deleted card are not possible, but you have other options to return a product.

One thing is certain, while virtual cards can create a buffer between hackers and your main debit card, they are not the perfect protection. For example, vendors can double charge you by mistake or might never ship your goods. In such cases, your protection is to dispute a transaction with the chargeback mechanism.

Mobile payments

We mentioned this earlier - a virtual card could be tokenized and integrated with mainstream digital wallets such as Apple Pay, Google Pay, Samsung Pay, etc. This can enable you to make offline payments with a mobile device, in retail shops, by tapping your phone to the contactless terminal.

This may sound like a sweet option but mobile wallets protect your card with additional security layers - like scrambling the payment information on the route within the network (tokenization).

In essence, you won’t have any benefits by adding a virtual card to Apple Pay than if you add your plastic iCard Visa debit or iCard Visa Infinite.

Types of virtual

cards

Virtual card offers can differ in terms of where the money is held. For example, you may be able to use a virtual card instantly after account opening and funding. Some virtual cards may be reloadable or you might be given just the option to load it once with a particular balance. Other virtual cards get deleted automatically or manually.

Let’s explore the variations you may stumble upon:

Virtual debit vs virtual credit

What is the main difference between virtual debit cards and virtual credit cards?

What is a virtual debit card?

Draws from account balance

What is a virtual credit card or VCC?

Draws money from a credit line

Like with most international cards, they can only work within a particular network - VISA, Mastercard or another, and they have no physical carrier. We have covered the differences more in-depth in a separate blog post.

Instant vs approved

What is an instant virtual card and when does it take time to get one?

What is an instant virtual card?

Instantly issued after the account is created and funded

What is an approved virtual card?

Approved after identity verification

You might stumble upon offshore providers that can grant virtual card numbers instantly after funding a newly created account. Should you require the stability of an EEA-regulated virtual card provider, you would most likely have to register an account and get identified online, before you can start ordering (creating) virtual cards instantly. At least that’s how things work with iCard and our European competitors, some of which we list below - in a separate section called “Selecting your virtual card”.

Disposable vs deletable

What is a disposable virtual card and is it really the best option for money safety online?

What is a disposable virtual card?

Automatically gets deleted from the VISA/Mastercard network, rendering it useless.

What is a deletable virtual card?

Manually deleted, after a single-use, to cancel a subscription or if no longer needed

On a first look disposable virtual cards seem like a genius idea - they get deleted the moment you use one for payment. No need to worry if your card data gets stolen or leaked in a data breach. However, this use-case does not accommodate all online shopping needs like subscriptions for games, films or paid content.

iCard offers 2 free virtual cards - one VISA and one Mastercard. You can delete both when needed, and you can buy new ones with a few taps.

Be cautioned:

Some purchases and bookings, such as buying concert or train tickets, may require you to present your card at pickup. You will most likely be OK if you can present your ID instead of the card you used for the payments. Using a normal card in such circumstances might save you some time explaining.

Virtual gift cards

What are virtual gift cards?

They are prepaid gift cards that work at particular retailers or anywhere VISA or Mastercard are accepted.

They work like physical gift cards, but having no plastic carrier makes it easy to send to anyone - instantly.

You may want to explore how easy it is to send virtual gift cards to family, friends and for any special occasion - to anyone in Europe. We have prepared a more extensive blog post, explaining why it is OK to gift money and exactly what problems do gift cards solve.

Virtual prepaid cards

Virtual prepaid cards are a variation of the more common types listed above. They are a payment card that stores the value on the card itself, not in a separate IBAN account or credit line. Virtual prepaid cards expire at a particular date or when the balance, which cannot be topped up, expires.

Shopping with

Virtual cards

Where can I pay with a virtual card?

Our user base here at iCard has a lot to say about where people spend their virtual card money.

We get a lot of great feedback through campaigns, events, product launches and the standard ratings in the app stores.

We took a look at the data for the past years to uncover the trends:

Online sellers

So, where can I shop with a virtual card?

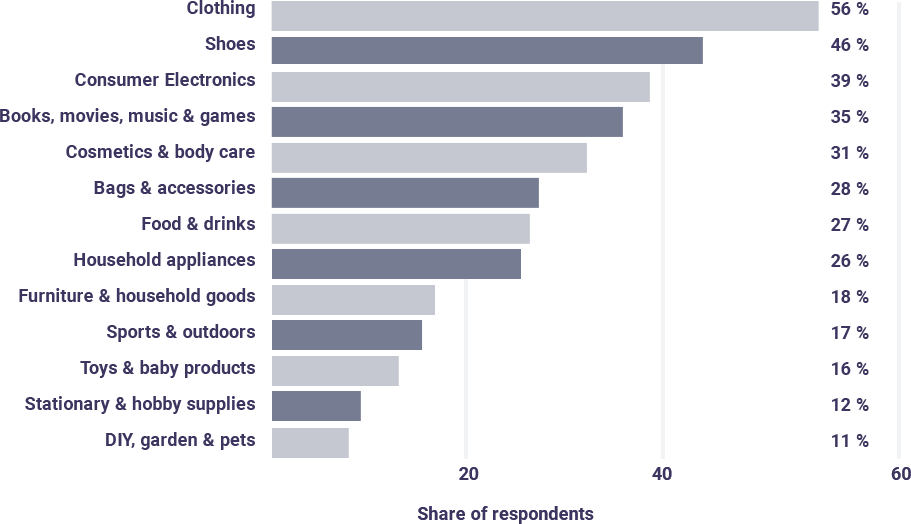

Most money spent with virtual cards goes for online shopping for clothing and shoes, electronics, books, movies, music and games. Followed by cosmetics & body care, bags & jewellery, foods & drinks, household appliances, furniture and household goods, sports & outdoor, toys & baby products, stationery and hobby supplies, DIY, garden and pets.

See the precise distribution, visualised by categories:

Subscriptions & entertainment

Using dedicated virtual cards for different recurring payments can give you important information on your spending and additionally - easier control over your subscriptions. For example, you can use a separate virtual card for each of your paid online channels. Deleting one virtual card for a particular subscription will not affect your other subscriptions.

Or, you can keep all of your online subscriptions on one virtual card and have an overview of the money you spend. Should you no longer need them, cancelling all at once could be as easy as deleting your virtual card with a couple of taps on your phone.

Services paid online

These can be offline services like a gardener or plumber, hired through Fantastic Services, or a freelance graphic designer, hired on Upwork to craft-up a few visuals and a logo for your personal blog.

You might be the freelancer yourself, making time for a few extra hours of earnings. Depending on your speciality, you might need copywriting services, stock images or videos, or even outsource some of the work you get. For anything that needs to be paid online, you have the option of using and designating one of your iCard virtual cards. It will not expire immediately and you can name it for convenience. You can connect a new virtual card to a new IBAN account to fund just enough money for the payments you need to make and budget more easily. A disposable virtual card can’t work in case you want to pay for recurring online services.

Our virtual card users also regularly spend on gaming, betting, trading and cryptocurrencies platforms.

Paying with virtual cards

How to use virtual cards to check out online?

Shopping online shouldn’t require a physical card to handle these transactions. When you are at the checkout page, simply login to your virtual card app and copy the card details into the payment form. It’s like pulling your debit card out of your wallet, without the risk of losing it.

Getting your virtual cards ready for shopping has some prerequisites, like selecting a provider for your needs, opening an account and/or verifying your identity, but more on that is coming up.

How to see the card numbers and make a payment with a virtual card?

Every provider has its own system to access your virtual card details.

With iCard, for example, you open the app and tap the virtual card you want to use to reveal its number:

There are a few things to consider like the speed and convenience. An app would usually give you the card details much faster than if you log in to a web browser from your phone.

Can I make mobile payments at retail stores with virtual cards?

As mentioned previously, it may be possible to pay at a physical store with your virtual card, via mobile payments, but that depends on your card provider and how extensively they are integrated with third parties such as Google Pay, Samsung Pay, Garmin Pay, etc.

You may be able to find virtual cards that can be “tokenized” and used with mobile wallets such as Apple Pay, but that may cause issues. For example, deleting or disposing of a virtual card will make you unable to pay with your Apple wallet the next time, unless you add a new virtual card.

At iCard, we are considering the tokenization of virtual cards. In the future, when all ATMs are contactless, having a virtual card added to a digital wallet could render physical cards useless. This could mean total reliance on your phone and battery. We are not quite there yet. A few prerequisites need to be met - making sure your phone will not break and leave you “cash-less” or run out of charge after prolonged use, at the time you need it the most.

Refunds

Can I get a refund to my virtual card?

Refunds are part of normal business and oftentimes buyers exercise their right to request a refund for defective or unwanted products. However, getting your money back to a virtual card may be impossible if you delete the virtual card or if it was disposable and erased after one payment. One solution is to make sure you don’t delete the card if you might expect a refund. Another solution is taking store credit or a gift card instead of a refund.

Use a virtual card provider that lets you keep all, receipts, even those made with a deleted virtual card. This may be the only way to prove you bought the product at that retailer. Beyond refunds, you should have a record because you need to be protected if an unexpected charge connected to that number appears in your statement.

Selecting your

virtual cards

As you can already see, the world of virtual cards can present a lot of options. In this section, we will outline some of the benefits and disadvantages of the issuing platforms, the providers, the costs and the features you should be looking for.

In the end, you will get to see how quick and easy it is to open an account with iCard and get going quickly with virtual cards, IBAN accounts, free & instant transfers, GiftCards and much more, just like it’s supposed to be in modern days.

Let’s dive into the details, so you can make a better choice, aligned with your habits and expectations.

Issuing platforms: Mobile and online

Do you want a virtual card app or online portal for virtual debit card access?

Every virtual card issuer has its own user-facing platform.

In general, the more options you have, the more likely it will be a fit for your lifestyle.

In your particular case, pricing may be a major factor, so let’s explore the possibilities:

The cost

How much do virtual cards cost?

They can cost anywhere from free to 1.00 EUR … All the way up to 50% of the amount funded into the virtual card.

We have summarized some of the basic costs in section “List of providers” below.

The features

Does my card have a CVV/CVC code and expiry date? Can I instantly get a new virtual card, on-demand? Do I need a VISA or Mastercard?

These are just some of the questions you should ask, before finding your perfect solution.

Consider all of the following:

Access platform:

How do you access your virtual cards? Online or via an app?

Card network:

Do you need VISA or Mastercard, or both?

The number of cards:

Do you need just 1 card that you will unfreeze for each transaction or do you want to have many and delete them at your wish?

Account:

Do you need to have virtual cards connected to IBAN accounts in different currencies?

Expiration:

Do you need it expiring immediately or when you decide to delete it?

Controls:

How do you freeze/unfreeze your virtual cards for maximum protection, if they don’t expire after each purchase.

Notifications:

Should you get an instant notification for every transaction, just in case something unexpected happens?

Limits:

Do you need custom payment limits on each virtual card? For example, you may want to limit monthly transactions to 30 EUR for a particular ongoing subscription. Maybe you need higher limits than most normal usage?

OCT:

Do you need to receive Original Credit Transfer, which is a way to receive payments directly to your card, not your IBAN account, for example from gambling websites.

3D Security:

Do you need all the security features possible, like “Verified by VISA” or “Mastercard Securecode”?

List of providers

How to select a virtual card provider?

Not every debit or credit card-issuer can offer you virtual cards protection. Some have, in the past and given up, due to lack of demand. Others, like us, see a great need for virtual cards and believe this is an essential part of any modern account.

Banks, fintech companies, payment processors and e-money institutions may be offering various types of virtual cards. A quick search for virtual cards in Google Search, Google Play and the App Store could give you a mix of region-specific or EU-wide providers.

We made a convenient list of virtual card providers, but it’s possible that any of your local banks could potentially offer a similar service without advertising it.

List of virtual card providers

“Get 2 free virtual cards for safe online shopping! It is a debit card that does not exist physically, thus it’s only suited for online payments for products, software and services. iCard gives you 2 free virtual cards that you can find in your digital wallet. You can easily buy up to 20 virtual cards, load and delete them. You’ve got the options to set your own spending limits, freeze/unfreeze cards and choose custom designs.”

- VISA & Mastercard

- Online access, apps for Android & iOS

- EUR, GBP, CHF, USD, RON, BGN

- Available in EEA

- 1.00 EUR for a card issuing (1 FREE VISA & 1 FREE Mastercard)

- 0.00 EUR monthly/annual fee

- 1.00 EUR fee for payment to the card (OCT)

“ecoPayz was launched in 2013 together with its product range: ecoAccount, ecoCard, ecoVirtualcard, ecoPayz Business Account, and the ecoPayz Merchant Account. The ecoVirtualcard is a one-use payment card (expires after one use) that works directly with the user's ecoAccount so the owner can securely pay for goods online and over the phone, without displaying any personal or financial information. The ecoVirtualcard can be purchased instantly with no credit checks or bank account required.”

- VISA

- Online access, apps for Android & iOS

- EUR, GBP, USD

- Available in EEA

- 1.80 EUR for a card issuing

- 4% fee for cash services & payment to the card (OCT)

- 2.99% currency conversion fee

“The premium cross-border shopping service. Shop at U.S. websites from anywhere in the world using our virtual payment cards with U.S. billing addresses.”

- One-time use, Merchant specific

- Online access only

- USD

- Available worldwide

- $15.00 enrollment fee

- $3+3% funding with bank transfer

- $0.5 transaction fee

- $3.5 monthly fee

The Skrill Virtual Prepaid Mastercard® allows you to use the funds in your Skrill Account to make online purchases wherever Mastercard® is accepted. As it is a virtual card, it cannot be used offline or at ATMs.

- Mastercard

- Online access, аpps for Android & iOS

- EUR, PLN, GBP, USD

- Available in EEA

- 2.50 EUR for a card issuing (1st card is FREE)

- 10.00 EUR annual fee

- 3.99% currency exchange fee

“Virtual prepaid Visa and Mastercard bank cards that allow you to pay for goods and services anonymously online. We work worldwide so you can purchase virtual prepaid cards from anywhere in the world and use them to pay online on any websites that accept Mastercard or Visa prepaid cards.”

- VISA & Mastercard

- Online access

- USD, CAD

- Available worldwide

- 10%-50% purchase fee

“Free virtual cards with the free plan. Disposable virtual cards come with any of the paid plans - 7.99 EUR/mo for а premium plan or 13.99 EUR/mo for а metal plan.”

- Mastercard

- Apps for Android & iOS

- GBP, EUR

- Available in EEA

- Free virtual card with free account

- Disposable virtual card with а paid plan

“You can now create a virtual card for your Monese account! With just a few taps on your phone, you’ll be able to set up and start using your Monese virtual card right away for a simple and safe payment process directly from your mobile.”

- Mastercard

- Online access, аpps for Android & iOS

- EUR, GBP

- Available in EEA

“phyre is a mobile app that turns your phone into a digital wallet. You can use it to easily shop anywhere with a POS and online. At the same time you can store all of your loyalty cards in the app and use them directly from your phone. phyre also allows you to send and receive money instantly and with no fees within the community.”

- Mastercard

- Apps for Android & iOS

- EUR, GBP, BGN, RON

- Available in EEA

- Only 1 free virtual card available

“Fillit is a prepaid card service that allows users to transfer money from their accounts or other merchants such as e-shops and others on a plastic or virtual Fillit Prepaid Mastercard® and allows them to use this card as any other worldwide payment card. Fillit.eu and Fillit trademarks belong to Streamflow EOOD, a company based in Bulgaria, founded in 2014.”

- Mastercard

- Online access

- EUR

- Available in EEA

- 12.00 EUR per virtual card

- 1.50 EUR account monthly fee

“Our virtual prepaid card is a simple, straightforward way to pay for your online shopping. One of the benefits of applying for a virtual card from PFS is that it does not take up space in your wallet or purse. Nor can you lose it. You can use one to buy almost anything from websites that accept Mastercard cards. It is a versatile product for fast, secure online payments.”

- Mastercard

- Online access

- EUR, GBP

- Available in EEA

- Fees are not available

Opening account

How to get virtual cards online? What is the process of opening an account?

Have you made up your mind which virtual card provider will work best for you? iCard is a feature-rich digital wallet that is available for EEA residents after verifying your identity online - via our Android or iOS app.

We can guide you through the easy steps to open an account and get access to 1 free VISA and 1 free Mastercard virtual card.

- Download iCard

- Register with your email and phone

- Verify your identity to get the forever free Standard account

Done! Now fund your digital wallet and pay with your virtual card. You can name each virtual card for convenience, freeze/unfreeze it, get notifications or simply delete it.

Want to find out more about iCard?

Go to iCard.com